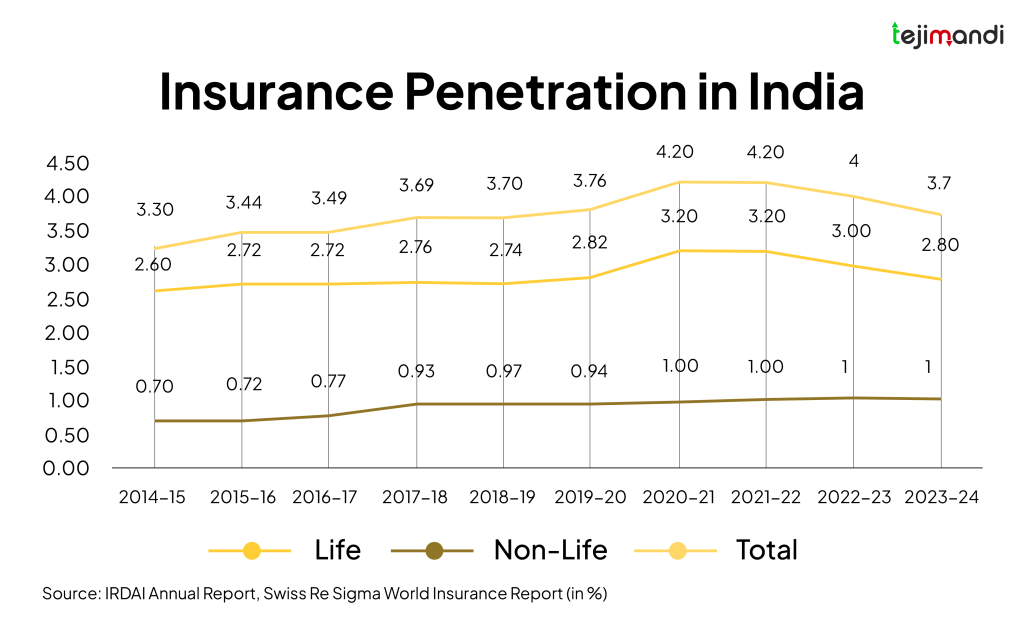

Indias Insurance Penetration Below 5%: Despite being the world’s most populous country and one of the fastest-growing economies, India’s insurance penetration still lags significantly behind the global average. According to the latest data from 2023-24, India’s insurance penetration—the ratio of insurance premium to GDP—remains below 5%, highlighting a deep-rooted issue in financial protection and risk coverage. This is not merely a challenge of affordability but also one of perception and trust. On National Insurance Awareness Day 2025, industry experts and analysts are urging a more nuanced understanding of the root causes that hold back millions from purchasing insurance.

Insurance density, a measure of the average insurance premium paid per person annually, further underlines the concern. In India, the insurance density was a modest USD 95, compared to the global average of USD 889. To put it into perspective, developed economies like the United States and the UK see per capita insurance expenditures exceeding USD 2,000. While digitization and innovative fintech solutions are helping reach new demographics, the overall trust in insurance products remains limited, especially in rural and semi-urban areas.

One of the more understated yet significant hurdles is the perception problem. Many Indians still view insurance as an expense rather than a safety net. The lack of personalized products, overcomplicated policy terms, and prior experiences of claim rejection have created a trust deficit. These issues collectively contribute more to the low penetration rate than pricing itself. Let’s delve deeper into how insurance works, who can apply, the associated costs, and how it can benefit individuals and families in today’s uncertain world.

Who Can Apply for Insurance in India?

Insurance is available to all Indian residents, with some policies also open to Non-Resident Indians (NRIs) depending on the provider. Applicants must generally meet the following criteria:

Eligibility Criteria:

- Age Limit: Most policies have an entry age between 18 and 65 years. For life insurance, the minimum can be as low as 1 year (for child plans).

- Citizenship: Indian citizens and NRIs (selective policies).

- Documentation:

- Aadhaar Card

- PAN Card

- Passport-sized photograph

- Income proof (for high-value policies)

- Medical reports (for certain health or term insurance plans)

Also read: Banks & Insurance Mis-selling: DFS Secretary’s Strict Warning & What It Means for You

Insurance Fees in India (Premiums & Costs)

What is a Premium?

A premium is the amount paid by the policyholder to keep the policy active. It can be paid monthly, quarterly, annually, or as a lump sum depending on the plan.

Types of Fees:

| Insurance Type | Average Annual Premium |

|---|---|

| Term Life Insurance | ₹3,000 – ₹10,000 |

| Health Insurance | ₹5,000 – ₹25,000 |

| Motor Insurance (Car) | ₹2,500 – ₹15,000 |

| Bike Insurance | ₹1,000 – ₹5,000 |

| ULIPs | ₹12,000 – ₹50,000+ |

Premiums are calculated based on age, income, coverage amount, health condition, and policy type. Discounts are often available for online purchases and multi-year plans.

How to Use Insurance and Its Benefits

Using Insurance Effectively:

- Step 1: Policy Selection – Choose a plan based on your specific needs (health, life, motor, etc.)

- Step 2: Payment of Premiums – Ensure timely payments to keep the policy active.

- Step 3: Claim Process – Submit documents and proofs (medical, police FIR, death certificate, etc.) when filing claims.

- Step 4: Settlement – If all conditions are met, claims are settled within 7–30 days.

Benefits:

- Financial Protection: Offers a safety net in case of death, disease, accident, or property damage.

- Tax Savings: Premiums paid can be deducted under Section 80C and 80D of the Income Tax Act.

- Peace of Mind: Reduces stress during emergencies by covering major costs.

- Investment Growth: Some policies like ULIPs and Endowment Plans help grow your money.

How to Apply for Insurance in India

Online Process (Preferred):

- Visit the insurer’s official website or aggregator platform.

- Compare plans using filters (coverage, premium, age, etc.).

- Fill in personal details and upload documents.

- Choose payment mode and make the premium payment.

- Receive policy via email or post.

Offline Process:

- Visit the nearest insurance office or consult an agent.

- Fill out the application form and submit required documents.

- Undergo a medical check-up (if required).

- Make the payment and collect the receipt and policy documents.

Important Dates in 2025 (Awareness Campaigns)

| Event | Date |

|---|---|

| National Insurance Awareness Day | June 28, 2025 |

| IRDAI Campaign Week | Oct 1 – Oct 7, 2025 |

| Life Insurance Awareness Month | September 2025 |

| Health Insurance Day | May 11, 2025 |

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute professional financial advice. Readers are encouraged to consult licensed agents or certified advisors before purchasing any insurance policy. Rates and coverage details may vary by company, location, and individual health/financial conditions. Star Health Insurance

Indias Insurance Penetration Below 5% Conclusion

India’s insurance ecosystem is undergoing a transition—but the journey toward universal insurance coverage remains challenging. The sub-5% insurance penetration figure is not just a number but a reflection of larger socio-economic barriers. People are not just hesitant to spend but unsure about what they’re getting in return. Insurance companies must focus on simplifying policies, improving claim transparency, and building trust across demographics.

Moreover, government bodies like IRDAI, along with insurance providers, must work collaboratively to address myths surrounding insurance products. Running awareness campaigns, engaging with rural communities, and enabling micro-insurance models could help close the gap.

With increasing climate risks, medical inflation, and financial instability, the need for affordable and accessible insurance is more urgent than ever. Digital channels have made the process easier—but the human element of guidance, empathy, and after-sales service still needs work.

Ultimately, insurance isn’t just a financial product—it’s a social safety net. A well-insured population is a resilient one, better prepared to handle life’s uncertainties. It’s time to move beyond affordability and pricing discussions and address the perception problem that’s silently holding India back.

Indias Insurance Penetration Below 5% FAQs

1. Why is insurance penetration so low in India despite rising incomes?

India’s insurance penetration remains low due to lack of trust, complexity of products, poor claim experiences, and limited customization. Even with rising incomes and internet penetration, the perception that “insurance is a waste” or that claims will be denied continues to discourage uptake.

2. What is the difference between insurance penetration and density?

Insurance Penetration is the percentage of total insurance premiums to GDP, reflecting overall market reach. Insurance Density, on the other hand, is the average amount of premium paid per person in a country. While penetration shows systemic spread, density indicates spending per individual.

3. Is digital insurance safer and better than offline agents?

Digital platforms offer ease of comparison, lower premiums, and faster processing. However, they may lack the personalized advice and accountability that offline agents offer. A hybrid model—buying online with expert consultation—is ideal for many consumers.

4. What types of insurance should every Indian have?

Every Indian should ideally have:

- Term Life Insurance (to protect family after death)

- Health Insurance (to cover medical expenses)

- Motor Insurance (mandatory by law)

- Personal Accident Insurance (for loss of income due to disability)

Optional: Critical Illness Cover, Travel Insurance, and Home Insurance.

5. Are government-backed insurance schemes worth it?

Yes. Government schemes like PMJJBY (life insurance at ₹330/year) and PMJAY (Ayushman Bharat) offer basic yet essential coverage at affordable rates, especially for low-income families. They are ideal for first-time or rural insurance adopters and act as a gateway to broader protection.