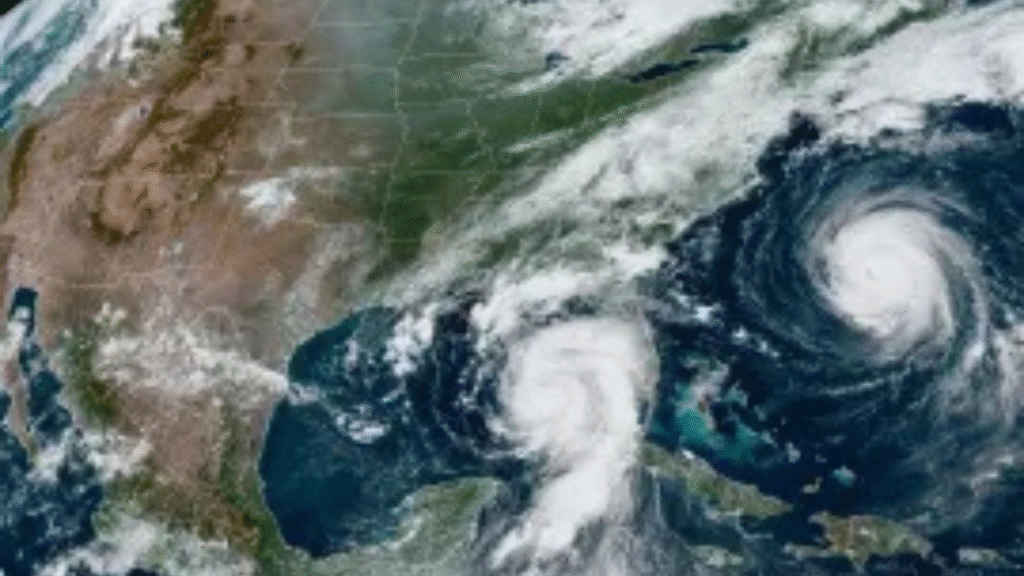

Australia and New Zealand Face Home Insurance Crisis Due to Climate Change: Homeowners in Australia and New Zealand are facing a growing home insurance crisis, largely driven by the escalating impacts of climate change. From devastating floods and wildfires to intense storms, extreme weather events are becoming more frequent and severe, causing billions in damages. These natural disasters not only impact lives and infrastructure but also significantly push up insurance premiums, threatening the affordability and accessibility of home insurance across the region. In 2022 alone, Australians claimed over $7 billion on home insurance due to a string of catastrophic floods—nearly double the previous record.

Experts warn that this rise in insurance premiums is a direct result of climate volatility. Areas deemed high-risk are seeing premiums more than triple compared to safer regions. In Sydney, average premiums have risen by 66% since 2020. As insurers withdraw coverage from vulnerable areas, homeowners may be left without insurance and unable to secure mortgage loans—undermining the stability of property markets and financial institutions. According to XDI’s Philip Tapsall, the consequences of inaction could destabilize entire communities, unless strong climate adaptation and emission reduction measures are implemented.

In New Zealand, similar trends are unfolding. Insurers are adopting property-specific risk pricing models, making it harder for owners in flood- or landslip-prone zones to get coverage. Major insurers like IAG have already stopped offering new policies for homes in highly vulnerable areas. The Insurance Council of New Zealand (ICNZ) reports that up to 20,000 homes face severe flood risks. A pending climate adaptation bill seeks to address these growing challenges through infrastructure investment and regulatory reform.

Who Can Apply for Home Insurance in High-Risk Zones?

Home insurance policies in Australia and New Zealand are typically available to all residential property owners. However, in high-risk areas (floodplains, wildfire zones, cyclone-prone regions), eligibility may be restricted:

- Eligible Applicants:

- Property owners with valid ownership documents

- Homes that meet insurer-specific safety standards (elevated foundations, flood barriers, fire-resistant materials)

- Ineligible Applicants:

- Properties deemed uninsurable due to repeated claims or unmitigated climate exposure

- Homes in red-zoned areas identified by local governments or councils

If you reside in a high-risk area, contacting your insurer or using climate risk tools (such as Climate Valuation) can help determine your property’s eligibility.

Also read: Why Home Insurance Prices Are Rising: The Impact of Climate Risk and How to Prepare

Insurance Fees and Rising Premiums Explained

Insurance premiums are calculated based on the risk profile of a property. In high-risk climate zones, these costs have surged dramatically. Here’s a breakdown:

| Region | Average Premium Increase Since 2020 | Typical Annual Cost (2024) |

|---|---|---|

| Greater Sydney | 66% | AUD $2,500–$4,500 |

| Eastern Australia Flood Zones | 100%+ | AUD $3,000–$6,000 |

| New Zealand High-Risk Homes | 70% | NZD $2,200–$4,000 |

Insurers like IAG, Suncorp, and Youi have begun to apply micro-location pricing based on risk models that consider local weather history, flood mapping, and government data.

How to Use Home Insurance Effectively

To make the most of your home insurance policy in the era of climate change:

- Understand Your Policy: Know what’s covered (flood, storm, fire) and any exclusions.

- Enhance Home Resilience: Install flood barriers, fire-proof roofs, and storm shutters to reduce premiums.

- Annual Reviews: Re-assess your policy yearly to account for property changes or new risk ratings.

- Claim Smartly: Document damages properly and maintain records for smooth claim processing.

- Use Government Support Tools: Use services like Climate Valuation to assess and mitigate risks.

Benefits of Having Home Insurance Amid Climate Risks

- Financial Security: Covers damages from floods, fires, cyclones, and storms.

- Loan Eligibility: Mortgage lenders typically require active home insurance.

- Peace of Mind: Reduces stress in disaster-prone regions.

- Property Value Protection: Ensures that homes remain insurable and marketable.

- Access to Support Services: Many policies include emergency accommodation, repairs, and disaster assistance.

How to Apply for Home Insurance in Australia and New Zealand

Step-by-Step Application Process:

- Evaluate Your Risk: Use tools like XDI’s reports or Climate Valuation’s assessments.

- Compare Policies: Use comparison sites or brokers to find climate-specific coverage.

- Get a Property Inspection: Some insurers require a certified inspection.

- Submit Application: Include ownership proof, past claim history, and risk mitigation evidence.

- Pay Initial Premium: Once approved, activate the policy by paying your first premium.

Important Dates to Remember

- Mid-2025: New Zealand’s Climate Adaptation Bill expected to be introduced.

- Q3 2025: Australia’s regulatory review of insurance access and mortgage risks concludes.

- Ongoing: Policy renewals and updated climate risk assessments by major insurers.

Disclaimer

This article is for informational purposes only. It does not constitute insurance advice. For accurate information regarding your specific policy or property, consult with licensed insurance providers or financial advisors. Regulations and policies may vary by region and change over time. Insurance Council of Australia

Australia and New Zealand Face Home Insurance Crisis Due to Climate Change Conclusion

Australia and New Zealand are on the frontlines of the global home insurance crisis fueled by climate change. With rising premiums and limited coverage, property owners are facing challenges that threaten not only their homes but also their financial stability. Without swift action on climate resilience and policy reform, entire communities risk becoming uninsurable.

Governments, insurers, and communities must work together to ensure sustainable, affordable insurance solutions. Investments in infrastructure, flood defenses, and green construction standards are essential to reduce future risks. Legislation like New Zealand’s upcoming adaptation bill could set a benchmark for other nations.

Consumers must also play their part—by understanding their coverage, improving home resilience, and advocating for policies that protect vulnerable regions. Tools like Climate Valuation help homeowners assess their risks and adapt effectively.

In the long term, transitioning to more sustainable practices and reducing carbon emissions will not only safeguard properties but also ease pressure on insurance markets. Climate change is here—how we respond will shape the future of homeownership.

Australia and New Zealand Face Home Insurance Crisis Due to Climate Change FAQs

1. Why are insurance premiums rising so rapidly in Australia and New Zealand?

Rising insurance premiums are largely driven by increasing climate-related disasters such as floods, fires, and storms. These events lead to more claims, causing insurers to raise premiums or withdraw from high-risk areas entirely. As climate change worsens, the frequency and severity of these events grow, making insurance more expensive.

2. Can I still get home insurance if my property is in a flood-prone area?

It depends. Some insurers now use detailed, property-specific risk assessments to determine eligibility. While some homes may still qualify with higher premiums or reduced coverage, others may be denied outright, especially if they’ve filed multiple past claims or fall into new risk zones.

3. What is the role of governments in addressing the home insurance crisis?

Governments are critical in setting regulatory frameworks, funding infrastructure resilience projects, and enforcing transparency in risk disclosures. In New Zealand, a Climate Adaptation Bill is being introduced, while Australia is reviewing insurance market regulations. These measures aim to ensure affordable coverage and market stability.

4. How can homeowners reduce their premiums or stay insured?

Homeowners can invest in mitigation measures like elevating homes, installing fireproof materials, or creating defensible spaces around their properties. Using risk assessment services like Climate Valuation can help in identifying weaknesses. Demonstrating these adaptations may reduce premiums or make the property eligible for insurance.

5. Is there any help available for homeowners who can’t afford rising premiums?

In some cases, governments provide subsidies or disaster recovery funds. Certain insurers offer risk mitigation incentives. Additionally, advocacy groups and financial services may help homeowners find alternative solutions, though support varies by region. Always check with local authorities and insurance councils for assistance options.