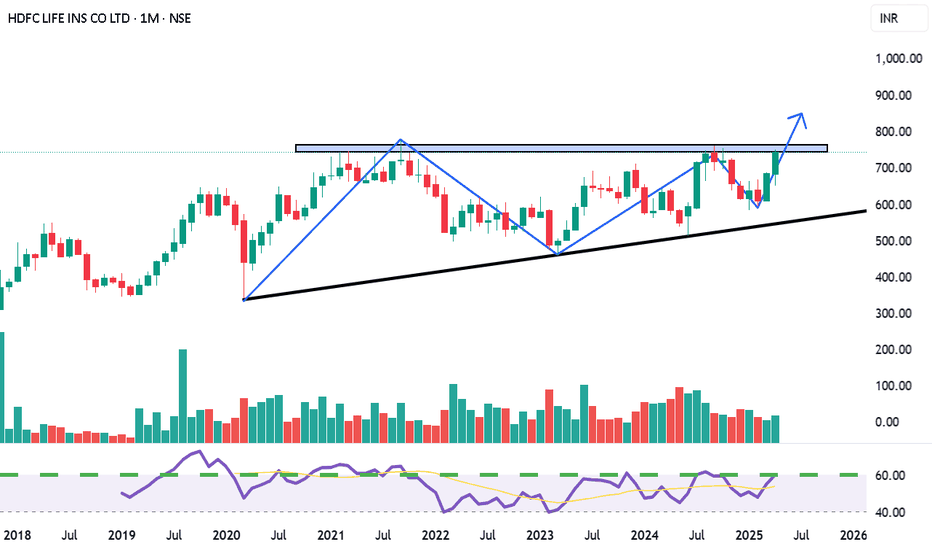

HDFC Life to Max Financial: The Indian life insurance sector is turning heads in 2025 with an impressive rally in stock performance. Leading players such as HDFC Life, LIC India, ICICI Prudential Life, and Max Financial Services have delivered monthly returns ranging from 5% to 13%, contributing to year-to-date (YTD) gains of 20% to 35%. This surge highlights investor confidence driven by strong financials, favorable policy changes, and rising insurance awareness among Indian citizens. As life insurance companies break resistance levels and reach record highs, savvy investors are reaping the benefits of a sector that was once deemed slow and stable.

One of the biggest policy drivers behind this growth has been the 2025 Union Budget announcement, where Finance Minister Nirmala Sitharaman increased the FDI (Foreign Direct Investment) cap from 74% to 100% in the insurance sector. This landmark decision has attracted global insurance giants to explore opportunities in India, while also enhancing the availability of capital to domestic insurers. Analysts predict that the capital influx will help insurers launch innovative products, boost operational efficiency, and most importantly, improve insurance penetration, which remains at a low 4% compared to the global average of 7%.

Corporate earnings have also played a vital role in uplifting investor sentiment. HDFC Life reported a 16% YoY rise in net profit to ₹477 crore, showing strong financial discipline and growth. While SBI Life posted a steady net profit of ₹814 crore, Max Financial Services saw a remarkable turnaround, posting a net profit of ₹38 crore in Q4 2025, compared to a loss of ₹50 crore last year. Market experts are bullish on these stocks, with HDFC Life breaking all-time highs and SBI Life surpassing resistance levels, signaling a continuation of the bullish trend.

Who Can Apply for Life Insurance in India?

Life insurance in India is available for:

- Indian citizens aged between 18 to 65 years.

- NRIs (Non-Resident Indians) with a valid Indian address and income proof.

- Salaried, self-employed, or even unemployed individuals (depending on insurer’s eligibility criteria).

- Individuals with pre-existing health conditions (subject to underwriting approval).

Life insurance companies like HDFC Life, Max Life, and SBI Life have simplified onboarding with online and offline application options.

Also read: How to Choose an Individual Health Insurance: Plan That Meets Your Needs in 2025

Insurance Fees & Premium Details

Insurance premium costs in 2025 vary based on the following:

| Insurance Plan Type | Average Premium per annum (₹) | Age Group | Sum Assured |

|---|---|---|---|

| Term Insurance | ₹4,000 – ₹12,000 | 25–45 years | ₹50L – ₹1Cr |

| ULIPs | ₹15,000 – ₹50,000 | 30–50 years | ₹10L – ₹50L |

| Whole Life Plans | ₹10,000 – ₹30,000 | 25–55 years | ₹10L – ₹25L |

| Child Education Plans | ₹12,000 – ₹30,000 | 25–40 years | ₹10L – ₹20L |

| Retirement/Pension Plans | ₹20,000 – ₹60,000 | 40–60 years | ₹10L – ₹50L |

How to Use Life Insurance and Benefits

How to Use Life Insurance:

- Risk Protection: Financial support to family in case of the policyholder’s death.

- Investment Tool: ULIPs and Endowment plans combine savings with insurance.

- Loan Facility: Some plans offer loan options against policy.

- Tax Benefits: Premiums are eligible for tax deductions under Section 80C.

Benefits:

- Guaranteed sum assured for the family.

- Flexible payment options (monthly, quarterly, yearly).

- Rider add-ons like critical illness or accidental death.

- Option to choose between term plans, ULIPs, and retirement plans.

- Digital management and claim settlement through mobile apps.

How to Apply for Life Insurance in 2025?

Applying for life insurance is now easier than ever. Follow these steps:

- Compare Plans: Use official websites like HDFC Life, SBI Life, and LIC India.

- Choose Sum Assured & Tenure: Based on your income and financial goals.

- Fill Application Form: Provide KYC details, medical history, and income documents.

- Medical Check-up (if required): Schedule as per insurer’s instruction.

- Policy Approval: On verification and underwriting, the policy will be issued.

Important Dates

| Event | Date |

|---|---|

| Union Budget 2025 Announcement | 1st February 2025 |

| FDI Cap Raised to 100% | Effective March 2025 |

| Q4 Earnings Announcements | April 2025 |

| Max Financial Turnaround Report | 15th May 2025 |

Disclaimer

This article is intended for informational purposes only. Stock market investments are subject to risks, and past performance is not indicative of future results. Consult with a certified financial advisor before making any investment decisions. Insurance policies are subject to underwriting guidelines of respective insurers. The data shared here is based on publicly available information as of May 2025.

HDFC Life to Max Financial Conclusion

In 2025, life insurance stocks are proving to be a golden opportunity for investors seeking stability and growth. With significant YTD returns and strong Q4 earnings, insurers like HDFC Life and SBI Life are making headlines for the right reasons. The favorable market dynamics, coupled with the Union Budget’s FDI reform, have laid the foundation for long-term sectoral expansion.

For policyholders and new applicants, this is an ideal time to explore a wide range of insurance products with better pricing, improved services, and digital ease of access. Whether you are looking for term insurance, ULIPs, or retirement plans, the market is brimming with options.

Moreover, increased foreign capital is expected to improve claim settlement ratios, customer support, and financial innovation. This will ultimately contribute to higher insurance penetration and financial literacy in the country.

If you’ve not considered investing in life insurance stocks or buying a policy yet, now is the time to take action. Both as a protective tool and a wealth creator, life insurance continues to evolve with the changing needs of modern India.

HDFC Life to Max Financial FAQs

1. What caused the sudden rise in life insurance stock prices in 2025?

The stock price rise is driven by strong Q4 earnings, policy announcements like 100% FDI allowance, and improved market sentiment. These factors signal better profitability and scalability for insurers.

2. How does 100% FDI impact the life insurance sector in India?

Raising the FDI cap to 100% allows foreign players to invest directly in Indian insurers. This increases capital availability, promotes healthy competition, improves product offerings, and enhances customer experience.

3. Is now a good time to invest in life insurance company stocks?

Yes, considering the bullish trend, positive quarterly results, and favorable government policies, 2025 is seen as a strong year for life insurance stocks. However, individual risk assessment and market research are recommended.

4. Can NRIs apply for life insurance in India?

Yes, NRIs can apply for life insurance policies from Indian insurers. They must provide proof of Indian origin, income documentation, and undergo required health checks. Many insurers offer customized NRI plans.

5. What are the tax benefits of buying life insurance in 2025?

Premiums paid towards life insurance qualify for tax deductions up to ₹1.5 lakh under Section 80C. Additionally, the sum received on maturity or death is usually tax-exempt under Section 10(10D), subject to conditions.